Three more uses for Xero expense claims

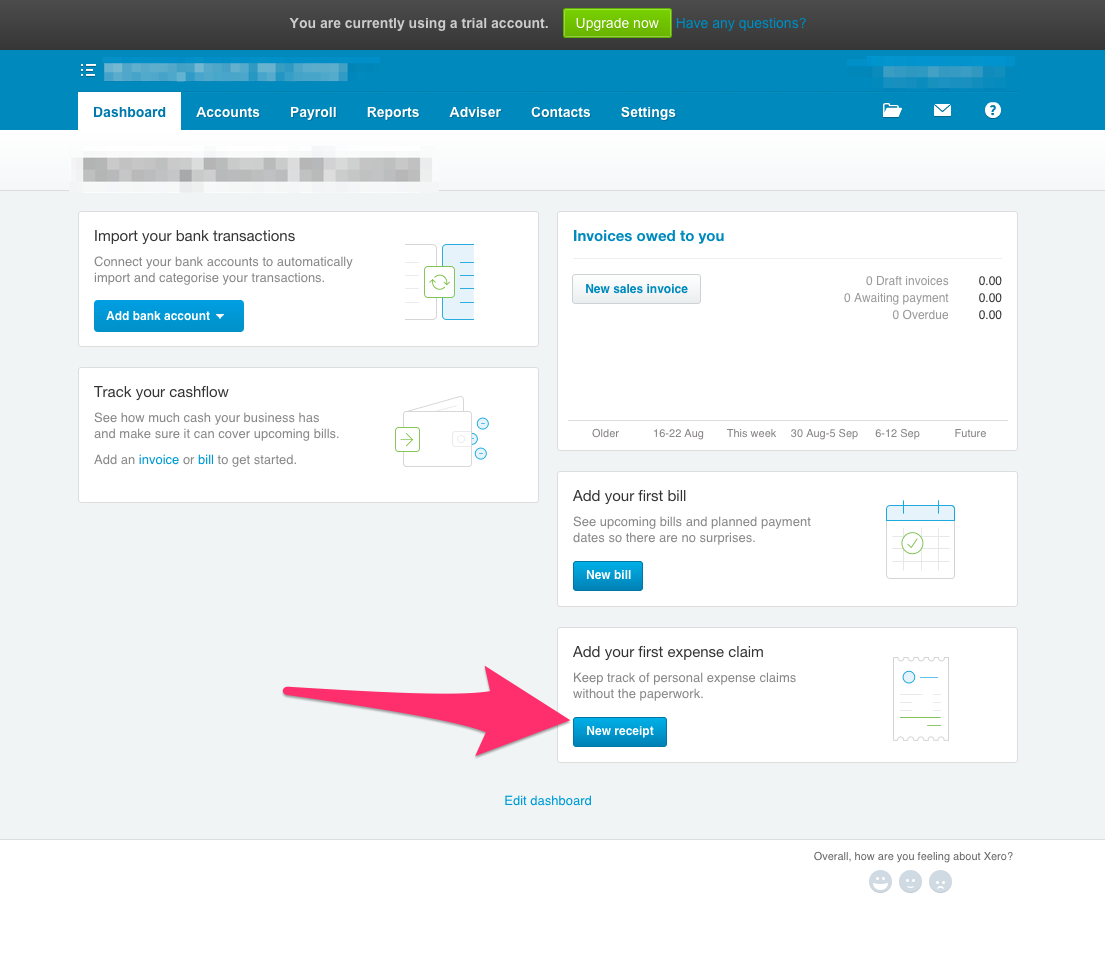

Expense claims in Xero are great for staff and founders to claim coffees, entertainment an other office stuff purchased on a personal card. Rather than look at how to complete an expense claim (done very well here), today we look at three other ways an expense claim can be used:

Pre incorporation expenses

Motor Vehicle Mileage

Per diem

Pre Incorportation Expenses

So you’ve started a company, registered for an IRD number, contacted the bank about a new account, thought about a website and started a Xero trial subscription. One of the first things you can do once Xero is set up is to enter your first expense claim! Expenses such as companies office costs and website hosting may have come from a personal card so will likely need to be imported into Xero.

Travel - Mileage

Even though “Mileage" is the wrong word for it in New Zealand, “kilometerage" is still too hard to get my head around. If you’re reimbursing founders and employees for business related travel then an expense claim is a great way to capture this information properly and get paid quicker.

In order to complete this in Xero:

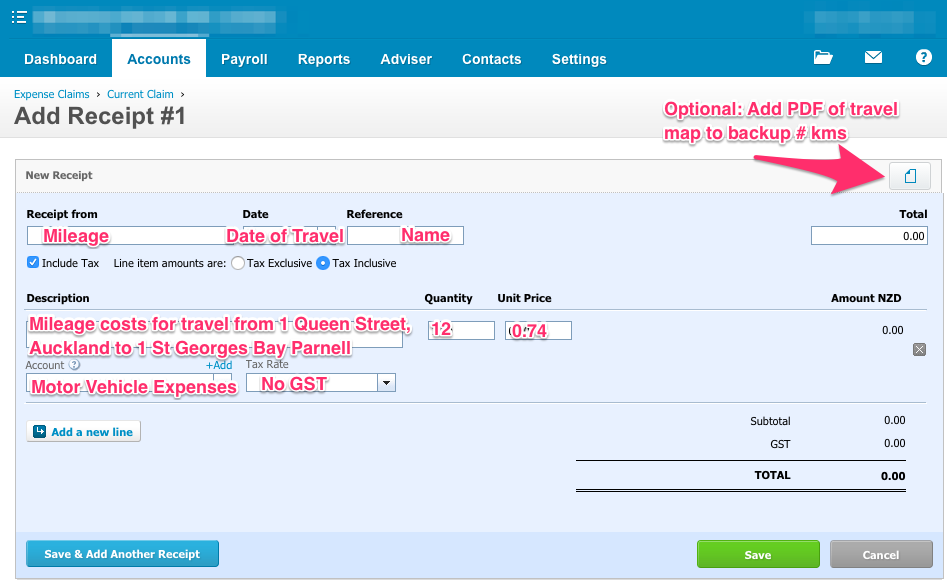

Receipt from: keep this consistent so it’s easier to see in reporting. “Mileage” or “Kilometerage” is fine.

Date: date of travel

Reference: can be anything like Employee’s name. An alternative way might be to put the Employee name under “Receipt from” and “Mileage” here.

Xero Files Button: optionally you could add an export of a map showing the travel completed in order to backup the mileage.

Total: leave this blank while you calculate your trips

Description: it’s useful to have the origin, destination and purpose of travel

Quantity: enter the total km’s for the trip here

Unit Price: enter the current rate allowable per km. The IRD currently has a rate of 74 cents but this is subject to change each year.

Account: Motor Vehicle Expenses

Tax Rate No GST

I’d generally add one line per trip, if you need further lines you can add these to one “Receipt”.

Per Diem

If your company requires long distance travel from its staff its likely you’ll need to pay a per diem for incidental expenses incurred such as meals and refreshments while travelling. Employees can use the Expense Claim option to record the per diem and get paid.

Receipt from: Employee / Founder name

Date: needs to be date of travel

Reference: Per Diem

Xero Files Button: no files needed

Total: leave this blank while you calculate your trips

Description: ensure to include: Dates of travel, Location of travel, Purpose of travel

Quantity: enter the total days for the trip here

Unit Price: this needs to be determined internally and may vary by country. Ask us for help with this.

Account: Travel Expenses

Tax Rate: No GST

*Please talk to us if you’re looking to pay a per diem. There may be tax consequences if not done correctly.

Other things to keep in mind:

- You’ll need to grant access to Xero for any employees. There are user permission options so that no important financial information is visible to certain users.

- Once an expense claim has been completed, it needs to be submitted for approval

- Once submitted, an Authorised person will need to approve, select due date for payment and reporting date

- Expense claim will still need to be paid from the company bank account to the personal account.

If you hear of any other ways to use expense claims please let us know!

Other Stuff you might like:

Disclaimer: Information provided to the best of the authors knowledge at time of publication. Laws are subject to change and independent advice should be sought. The above information is general in nature and should not be construed or relied on as a recommendation.